How Capital Gains May Impact Real Estate Decisions

-

January 2026

- Jan 19, 2026 What To Expect In Real Estate Trends For 2026 Jan 19, 2026

- Jan 11, 2026 Book of the Month: Deep Work by Cal Newport Jan 11, 2026

- Jan 4, 2026 Your One Action for 2026 Jan 4, 2026

-

December 2025

- Dec 31, 2025 Top Stories of the Year Dec 31, 2025

- Dec 19, 2025 Book of the Month: Mastery by Robert Greene Dec 19, 2025

- Dec 15, 2025 Removing Popcorn Ceilings For a Cleaner Finish Dec 15, 2025

- Dec 7, 2025 Late Fall Real Estate Market Updates Dec 7, 2025

-

November 2025

- Nov 23, 2025 Book of the Month: Peak: Secrets From the New Science of Expertise by Anders Ericsson and Robert Pool Nov 23, 2025

- Nov 19, 2025 8 Home Maintenance Tasks To Check Off Your List Before Winter Nov 19, 2025

-

October 2025

- Oct 23, 2025 Book of the Month: Find Your Why by Simon Sinek Oct 23, 2025

- Oct 13, 2025 How Capital Gains May Impact Real Estate Decisions Oct 13, 2025

- Oct 2, 2025 Me Meetings to Get Priority Tasks in Order Oct 2, 2025

-

September 2025

- Sep 25, 2025 5 Soccer Teambuilders Any Coach Can Use Right Now Sep 25, 2025

- Sep 17, 2025 What to Know about a Home Appraisal Contingency Sep 17, 2025

- Sep 11, 2025 Teambuilding to Start the Season on the Same Foot Sep 11, 2025

- Sep 5, 2025 Book of the Month: The 5 Types of Wealth by Sahil Bloom Sep 5, 2025

-

August 2025

- Aug 28, 2025 Rent vs Buy: By the Numbers Aug 28, 2025

- Aug 22, 2025 Leaving Everything on the Field Aug 22, 2025

- Aug 17, 2025 Books of the Month: The Creative Act: A Way of Being by Rick Rubin and The War of Art by Steven Pressfield Aug 17, 2025

- Aug 13, 2025 Rent vs Buy: How to Choose Aug 13, 2025

- Aug 6, 2025 Inspection Contingencies and Timelines Aug 6, 2025

- Aug 3, 2025 Lessons From Painting and Soccer Camp Aug 3, 2025

-

July 2025

- Jul 23, 2025 Finding the Point Jul 23, 2025

- Jul 16, 2025 Book of the Month: Think Like a Monk: Train Your Mind for Peace and Purpose Every Day by Jay Shetty Jul 16, 2025

- Jul 9, 2025 Real Estate Market Updates: June 2025 Jul 9, 2025

- Jul 2, 2025 Taking Time Out to Re-Align Jul 2, 2025

-

June 2025

- Jun 25, 2025 Navigating Home Sale Contingencies Jun 25, 2025

- Jun 17, 2025 The Crossing Fawn Jun 17, 2025

- Jun 4, 2025 Book of the Month: Notes from a Deserter by C.W. Towarnicki Jun 4, 2025

-

May 2025

- May 29, 2025 We Are What We Eat May 29, 2025

- May 22, 2025 The Ins and Outs of Mortgage Contingencies May 22, 2025

- May 8, 2025 Coaching Fundamentals: Reflect and Repeat May 8, 2025

-

April 2025

- Apr 23, 2025 How Rory McIlroy Remained Present to Win the Masters Apr 23, 2025

- Apr 2, 2025 Coaching Fundamentals: Mastering the Demonstration for Player Understanding Apr 2, 2025

-

March 2025

- Mar 12, 2025 Book of the Month: Atomic Habits by James Clear Mar 12, 2025

-

February 2025

- Feb 27, 2025 5 Answers For Potential Homebuyers Entering the Spring Market Feb 27, 2025

- Feb 6, 2025 Investing Basics with Chris Strivieri, Founder and Senior Partner of Intuitive Planning Group in Alliance with Equitable Advisors Feb 6, 2025

-

January 2025

- Jan 30, 2025 Book of the Month: The MetaShred Diet Jan 30, 2025

- Jan 20, 2025 Residential Housing Trends in 2025 Jan 20, 2025

- Jan 9, 2025 Understanding the Use and Occupancy Certificate Jan 9, 2025

-

December 2024

- Dec 4, 2024 Book of the Month: How Champions Think by Dr. Bob Rotella Dec 4, 2024

-

November 2024

- Nov 19, 2024 Professional Spotlight: Fran Weiss, Owner of Weiss Landscaping Nov 19, 2024

-

October 2024

- Oct 29, 2024 Book of the Month: Hidden Potential by Adam Grant Oct 29, 2024

- Oct 21, 2024 Professional Spotlight: James George, President, Global Mortgage Oct 21, 2024

- Oct 15, 2024 Buyers Post-NAR Settlement Oct 15, 2024

The real estate market has been kind to homeowners over the past fifteen years. It’s been so kind, in fact, that many long-term owners are analyzing payoff statements and home values as if watching Yamine Lamal dribbling inside from the right corner of the penalty box. Because of their growing equity, they’re now facing the possibility of paying tax on capital gains.

Capital gains tax is a tax one pays on any asset that makes a profit, whether it’s stocks, bonds, or real estate. There are two types of capital gains: short-term and long-term. Short-term capital gains are profits from selling assets held within a year or less. Long-term gains are from profits of assets held longer than a year.

Because short-term capital gains are taxed at normal income rate and long-term gains are taxed at a capital gains tax rate, which is lower, it makes more sense to hold onto an asset for a longer period of time. When it comes to real estate, homeowners will need to consider how capital gains influence their profits, especially if they are short-term investors.

However, there are several exclusions.

The IRS highlights a few main exclusions. “If you have a capital gain from the sale of your home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse.” (irs.gov)

This is what’s known as a Section 121 exclusion. In order to meet this exclusion, the owner must meet two criteria:

“You have owned and used your home as your main home for an aggregate of at least two years out of the five years prior to the date of sale. Any two-year period within the five-year window qualifies, and one would not qualify if the exclusion were used on another home in the same time period.” (irs.gov)

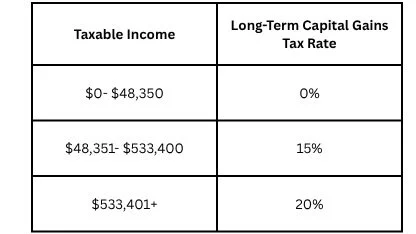

For the year, 2025, the rate of capital gains for someone filing as single would be as follows:

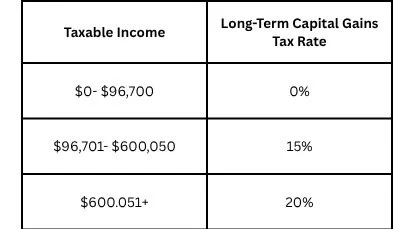

For a married couple, filing jointly:

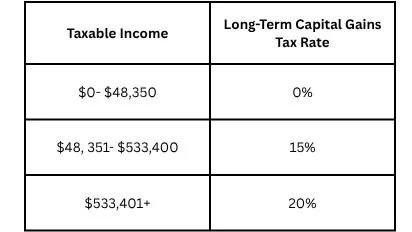

For a married couple, filing single:

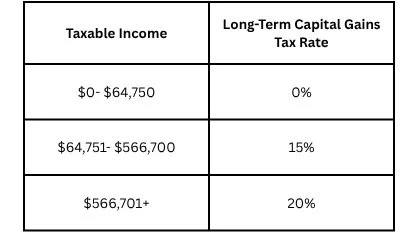

For head of household:

How to calculate capital gains:

1) Determine your basis. The basis includes the price of the purchased home plus any renovations. For example, if someone purchased a home for $500,000 and put $50,000 in to update the home, their basis would be $550,000.

2) Calculate the sale price minus sale costs. If the home sold for $750,000 several years later and the seller paid $30,000 in selling fees, the sale price is $720,000.

3) Find your gain. Subtract the basis from the sale price. If the sale price is less than the purchased price, the sellers nets a loss. In this example, the gain would be $170,000.

4) Adjust for the exclusion. If you are eligible for an exclusion, reduce the capital gain by $250,000 (if filing single) or $500,000 (if filing jointly). In this example, the taxable gain would be $0.

There are a number of additional exclusions and disqualifications. Here are a few of the more common ones, but it’s still important to speak with your tax advisor prior to listing your home to plan ahead. If you’ve recently sold your home, make sure you discuss the potential for taxable gains during the next filing period.

Some exclusions (mentioned in more detail in IRS publications):

Divorce or separation:

Death of a spouse

Member of the Uniformed Services, Foreign Service, the intelligence community, or Peace Corps

Home destroyed or condemned

Vacant land

Work-related move

Health-related move

Or

1031 Like Exchange (If you sell a home but use the profits to purchase a new one, this is considered a like-kind exchange. Profits from the sale can be excluded from capital gains tax, however, when the property is sold again, the profit will be subject to tax.)

More details can be found at: