Leaving Everything on the Field

-

February 2026

- Feb 21, 2026 Book of the Month: The 4 Disciplines of Execution by Chris McChesney, Sean Covey, and Jim Huling Feb 21, 2026

- Feb 9, 2026 How the Seller Disclosure Law of PA Affects Buyers and Sellers Feb 9, 2026

-

January 2026

- Jan 19, 2026 What To Expect In Real Estate Trends For 2026 Jan 19, 2026

- Jan 11, 2026 Book of the Month: Deep Work by Cal Newport Jan 11, 2026

- Jan 4, 2026 Your One Action for 2026 Jan 4, 2026

-

December 2025

- Dec 31, 2025 Top Stories of the Year Dec 31, 2025

- Dec 19, 2025 Book of the Month: Mastery by Robert Greene Dec 19, 2025

- Dec 15, 2025 Removing Popcorn Ceilings For a Cleaner Finish Dec 15, 2025

- Dec 7, 2025 Late Fall Real Estate Market Updates Dec 7, 2025

-

November 2025

- Nov 23, 2025 Book of the Month: Peak: Secrets From the New Science of Expertise by Anders Ericsson and Robert Pool Nov 23, 2025

- Nov 19, 2025 8 Home Maintenance Tasks To Check Off Your List Before Winter Nov 19, 2025

-

October 2025

- Oct 23, 2025 Book of the Month: Find Your Why by Simon Sinek Oct 23, 2025

- Oct 13, 2025 How Capital Gains May Impact Real Estate Decisions Oct 13, 2025

- Oct 2, 2025 Me Meetings to Get Priority Tasks in Order Oct 2, 2025

-

September 2025

- Sep 25, 2025 5 Soccer Teambuilders Any Coach Can Use Right Now Sep 25, 2025

- Sep 17, 2025 What to Know about a Home Appraisal Contingency Sep 17, 2025

- Sep 11, 2025 Teambuilding to Start the Season on the Same Foot Sep 11, 2025

- Sep 5, 2025 Book of the Month: The 5 Types of Wealth by Sahil Bloom Sep 5, 2025

-

August 2025

- Aug 28, 2025 Rent vs Buy: By the Numbers Aug 28, 2025

- Aug 22, 2025 Leaving Everything on the Field Aug 22, 2025

- Aug 17, 2025 Books of the Month: The Creative Act: A Way of Being by Rick Rubin and The War of Art by Steven Pressfield Aug 17, 2025

- Aug 13, 2025 Rent vs Buy: How to Choose Aug 13, 2025

- Aug 6, 2025 Inspection Contingencies and Timelines Aug 6, 2025

- Aug 3, 2025 Lessons From Painting and Soccer Camp Aug 3, 2025

-

July 2025

- Jul 23, 2025 Finding the Point Jul 23, 2025

- Jul 16, 2025 Book of the Month: Think Like a Monk: Train Your Mind for Peace and Purpose Every Day by Jay Shetty Jul 16, 2025

- Jul 9, 2025 Real Estate Market Updates: June 2025 Jul 9, 2025

- Jul 2, 2025 Taking Time Out to Re-Align Jul 2, 2025

-

June 2025

- Jun 25, 2025 Navigating Home Sale Contingencies Jun 25, 2025

- Jun 17, 2025 The Crossing Fawn Jun 17, 2025

- Jun 4, 2025 Book of the Month: Notes from a Deserter by C.W. Towarnicki Jun 4, 2025

-

May 2025

- May 29, 2025 We Are What We Eat May 29, 2025

- May 22, 2025 The Ins and Outs of Mortgage Contingencies May 22, 2025

- May 8, 2025 Coaching Fundamentals: Reflect and Repeat May 8, 2025

-

April 2025

- Apr 23, 2025 How Rory McIlroy Remained Present to Win the Masters Apr 23, 2025

- Apr 2, 2025 Coaching Fundamentals: Mastering the Demonstration for Player Understanding Apr 2, 2025

-

March 2025

- Mar 12, 2025 Book of the Month: Atomic Habits by James Clear Mar 12, 2025

-

February 2025

- Feb 27, 2025 5 Answers For Potential Homebuyers Entering the Spring Market Feb 27, 2025

- Feb 6, 2025 Investing Basics with Chris Strivieri, Founder and Senior Partner of Intuitive Planning Group in Alliance with Equitable Advisors Feb 6, 2025

-

January 2025

- Jan 30, 2025 Book of the Month: The MetaShred Diet Jan 30, 2025

- Jan 20, 2025 Residential Housing Trends in 2025 Jan 20, 2025

- Jan 9, 2025 Understanding the Use and Occupancy Certificate Jan 9, 2025

-

December 2024

- Dec 4, 2024 Book of the Month: How Champions Think by Dr. Bob Rotella Dec 4, 2024

-

November 2024

- Nov 19, 2024 Professional Spotlight: Fran Weiss, Owner of Weiss Landscaping Nov 19, 2024

-

October 2024

- Oct 29, 2024 Book of the Month: Hidden Potential by Adam Grant Oct 29, 2024

- Oct 21, 2024 Professional Spotlight: James George, President, Global Mortgage Oct 21, 2024

- Oct 15, 2024 Buyers Post-NAR Settlement Oct 15, 2024

As a young soccer player, one of the phrases embedded in my mind was “Leave everything on the field.”

It wasn’t my best effort unless I crossed the lines winded, burning, and cramping, Most coaches instill a similar mantra in their players to express the value of hard work.

Early in my professional journey, I was fortunate enough to work with some experienced professionals at the twilight of their careers. When they retired, most had grand plans to travel the world and do the things they never had time to do. But when I'd see them again, those plans were still on hold. This shaped my thinking about time-money-life experiences ever since.

In his book, Die With Zero, author Bill Perkins asks the reader to re-think our idea of saving for our post-retirement lives.

Perkins quotes a 2018 study from the Employee Benefit Research Institute that claims for retirees in their sixties to nineties, the median household spending to household income hovers around 1:1. He goes on to cite that retirees who had $500,000 or more right before retirement had spent a median of 11.8% of that money 20 years later or by the time they died. Despite having smaller margins, retirees with less than $200,000 saved for retirement had spent only one-quarter of their assets. Retirees on pensions spent only 4% during the first 18 years after retirement. Even with their limited spending, one-third of retirees increased their assets after retirement.

The point Perkins is trying to make is that we tend to over save and under spend in our retirement years, leaving the remaining balance to our family, favorite charities, or the government if we haven’t prepared.

The idea isn’t to promote reckless spending but to reconsider what we’re preparing for in the later years of our lives.

Eventually, this leads us to time.

We spend much of our adult lives understanding what our time is worth, but once we fully maximize the monetary value of our time, we have less physical capacity to enjoy it. So instead of retiring with visions of experiencing life to its fullest, most of us end up remaining in our worn paths, riding out our days, and never doing the things we’ve always wanted to do. We essentially die with a massive savings of time we never withdraw. All that time spent working and building leads to a treasure of unused experiences.

Perkins asks, why aren’t we leaving it all on the field?

We’re all familiar with the expression “Time is Money.”

What about “Time is Experience?”

How can we build experiential wealth that compounds over time?

At the end of the movie Shawshank Redemption, the narrator Red famously says, “Either get busy living or get busy dying.” Unfortunately, most of us spend our lives preparing to die while forgetting to prepare to live.

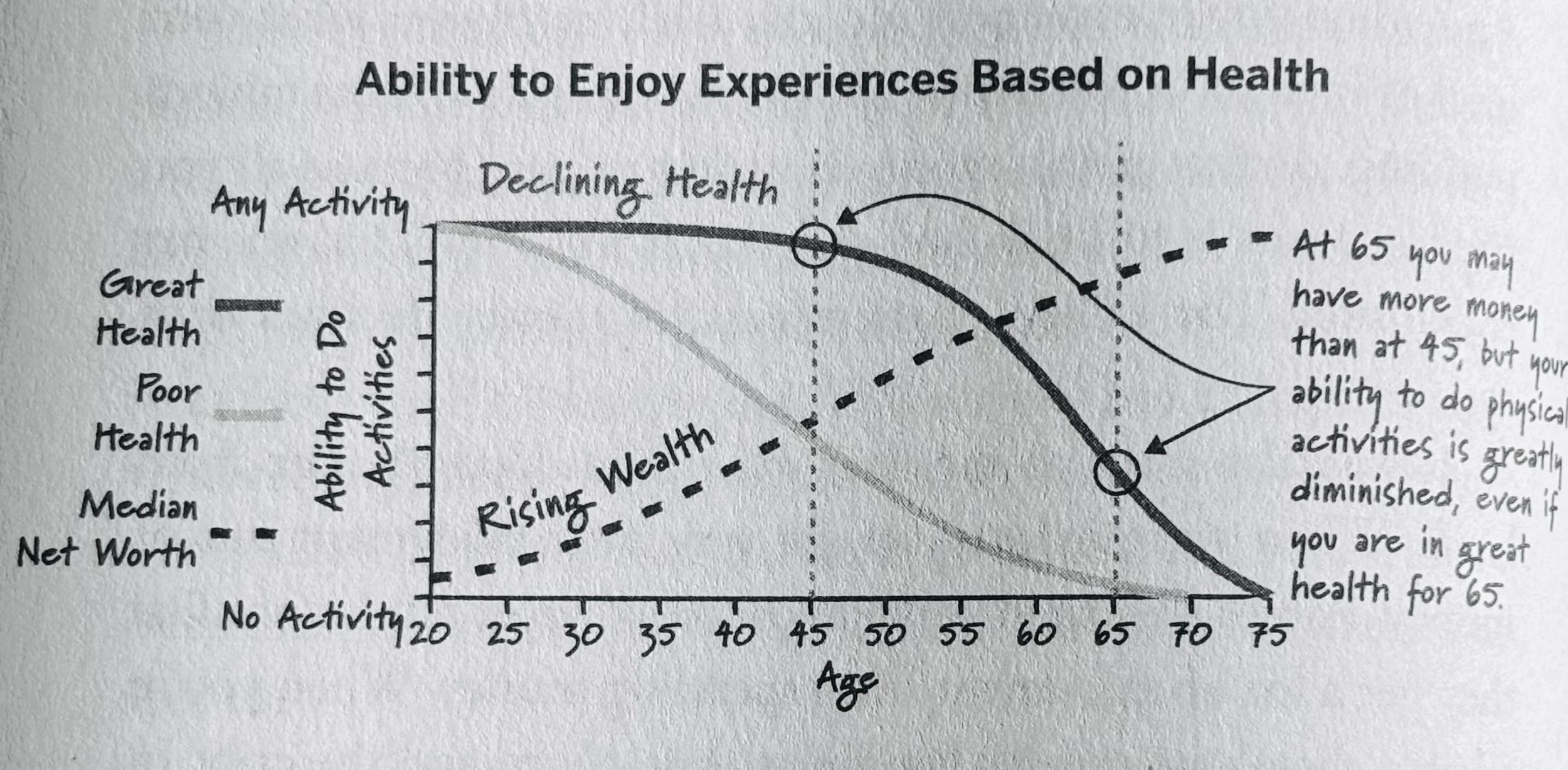

Referencing the graphic from the book, when we’re young, pre-marriage, pre-kids, we have ample amounts of time but no money. As we age and become more committed to our family, work, or community, we build wealth but lose time. All the while, our physical health remains strong while we work, provide, and save, until eventually we start to lose the capability to experience all we’ve been saving for.

Think of all the important meetings, double-shifts, overtimes, next projects, next tournaments—the priorities that replace the wealth of experiences we put off for a later date that never materialize.

What family vacation are you waiting for because “it’s not the right time?” Or because of a very important work commitment. Or because there’s a great opportunity to guest play in a big tournament for the special team.

Perkins isn’t advocating for no financial planning or succumbing to massive crippling debts. Dying with zero shouldn’t mean going broke in your 70s (even though we have a system in place that prevents that from happening, for now). He’s not saying don’t give money to family or charity, though he does recommend giving it while we are alive and can experience the full impact. He is suggesting to maximize the wealth of life experiences while we still can. Dying with zero means planning for a lifetime of experiences and financial contributions so we aren’t left with regrets.

Dying with zero means leaving everything on the field.